The 28 Basic Accounting terms and concepts necessary for small businesses to learn and record new ventures. These are basic terms that will help you as an owner to maintain the financial record in your Basic Bookkeeping easily.

The Glossary of Basic Accounting Terms

- Separate Entity

- Cost Concept

- Cash Basis Accounting

- Accrual Basis Accounting

- Single Entry System

- Double Entry System

- Matching Concept

- Realization Concept

- Accounting Period Concept

- Materiality Concept

- Assets

- Liabilities

- Owner’s Equity

- Income

- Expenses

- Accounting Equation

- Capital

- Drawings

- Goodwill

- Revenue

- Turnover

- Debit

- Credit

- Balance Sheet (Statement of Financial Position)

- Income Statement

- Account Receivables (AR)

- Account Payables (AP)

- Inventory

Separate Entity

The first easy and basic accounting term is a separate entity. When you start a business with a unique name and register with your country registration body, then it becomes a separate person apart from you. There are different types of business entities.

This separate business has a unique stamp and seal. It can agree or enter into an agreement with any person apart from you.

Accounting records consider the owner as a person who has lent his time and money on capital and wants to get back his capital with profit. All his money will be considered as equity which is a liability to the business.

Cost Concept

The second basic accounting term is Cost. All the material including assets, furniture, chairs, etc. which you have purchased for earning something is measured in terms of money. The money which you use to purchase all these assets and inventory has units in the shape of Dollar, Pound, Euro, Rupees, etc.

All costs of an asset from purchasing, loading traveling, unloading, installation at the original place till commercial operations become part of the Cost of that asset.

Cash Basis Accounting

There are two types of Accounting systems and one is Cash Basis Accounting. You have started a consultancy business and want to record cash transactions. At the start, you will enter only when you receive Cash and Pay Cash for expenses incurred during operations.

You do not consider prepaid expenses and advance incomes. You enter immediately to the relevant head of account as expenses or income.

This system cannot measure the accurate profitability of your business. This system does not consider your advance payments which you will adjust in three months as expenses. You are considering the whole amount as an expense for that month.

Accrual Basis Accounting

The second system of accounting is Accrual Basis Accounting, Which has a wide reputation and accepted at all levels of organizations. In this system, you consider only that part as an expense or income which is concerned with the current month or year of the financial accounting period. The rest of the amount belonging to next month or the financial year which you will consider as Account Receivable (current Asset) or Account Payable (Current Liability).

This system is different from Cash Basis Accounting and has universal application in organizations of different industries.

An example is an Insurance premium, which you normally pay for the whole year in advance. Now, you will divide all payments into twelve parts and will consider expenses that belong to the current month. The rest of the amount will be your advance payments as Account Receivables.

Single Entry System

There are two systems of Accounting for recording any financial event. One has a name as a Single Entry Accounting System. You enter all financial events in single rows on your daily entry book and do not consider the second aspect.

This is the oldest recording system which cannot fulfill the modern-day data requirements of any small business.

Double Entry System

The second recording system which is the base of modern-day accounting is the Double Entry System. Any financial event which you have to record presents two accounts. You have to write on the left-hand side of the page called credit and the other on the right-side as Debit.

This system bases future reports of Accounts like Trial Balance, Balance Sheet. Both sides of the account should be equal, which has a dual aspect in every transaction for the correct account.

So, being a small business owner, you have to learn a double-entry system to maintain all financial transactions accurately.

Matching Concept

All businesses earn something by providing services or products and pay expenses for normal operations. So, you compare all incomes with all expenses to get the difference between them. But, you have to compare related incomes with related expenses.

On the other side, You cannot compare future expenses with current income. This concept is the Matching Concept.

You will not compare previous incomes with current period expenses. As a result, this concept increases the accuracy of books and gets the real company’s financial position.

Realization Concept

This concept is the base of Accrual Basis Accounting. When you provide services or sell any product to any customer, your sales increase. You will not wait for sales entry at the time of Cash Payment from Customers. You realize a Sale when you deliver a service or product. The same scenario is with expenses.

The other scenario maybe, when you receive cash but do not provide service or product. Then you cannot consider this amount as your income or sales. You have not realized this sale yet.

Accounting Period Concept

You are the owner of a small business and preparing books of accounts. You need to close your books and prepare a final account for comparison with previous periods. Consequently, you are improving day by day and have to watch your financial progress as well.

This concern dictates you to determine a specific accounting period for your financial records and prepare final statements to monitor your success. This one of the basic concepts to finalize before the start of the accounting and bookkeeping process.

For this reason, accountants consider it a 12 months period and declare it from a specific date. This helps accountants to check the accuracy of their workings and put your work for more audit purposes.

Materiality Concept

The material concept or principle refers to the amount of transaction relative to the company’s financial position. The amount from which the financial position of any company can mislead its investors.

A company which has a turnover of millions can consider $500 is immaterial. Whereas on the other side, a firm having turnover in thousands considers it a material amount.

Auditors use the materiality concept in audit procedure as audit materiality.

Assets

This is a term you have to use frequently in business and is one of the basic accounting terms. The assets are the resources you own when you start a business. The furniture you are using in the office, fans, and inventory you purchase for further sales is also the current asset.

Assets may be tangible assets that have physical shape and structure. Intangible things that cannot be touched are also called intangible assets like patents, goodwill, etc.

Liabilities

One of the basic accounting terms is Liabilities. The resources you get from friends, family, and others as loans to start or use in your business and earn something are called liabilities.

The liabilities may be short term or current liabilities, which have to return in less than a year.

The liabilities which are repayable after 1 year are Long Term Liabilities.

Owner’s Equity

The third main part of the Balance Sheet after assets and liabilities is the owner’s equity in any business. Whereas you have already learned from previous sections about the business as a separate entity.

The resources you consume during starting a business in the shape of office chairs, fans, early payment of office rent, purchasing of inventory, etc is the owner’s equity.

Income

It is one of the key concepts and basic terms of financial Accounting. It is the return amount which you receive after selling your product or service to any customer.

You use Assets to earn income from the business. It is the total amount you receive from your basic business during a specified period of time.

Expenses

It is the cost you pay for earning any income from normal operations of the business. Expense is the item that is you deduct from total income to get profit from operations.

Examples of the expenses are Rent Expense, Utility Expenses, Entertainment Expenses, Stationery Expenses, Printing Expenses, etc.

Accounting Equation

It is one of the Basic Accounting Terms all accounting students learn to start this field. This basic Accounting Equation tells the financial position of a company.

The Balance Sheet total equals this Accounting Equation formula. The relationship between Assets, Liabilities, and Owner’s Equity is described in this Equation Formula.

Furthermore, it tells you how all your Assets are built, what resources you have used to maintain your company’s total financial position.

The Accounting Equation Formula:

Assets = Liability + Owner’s Equity

Capital

This is another one of the basic and fundamental concepts. Capital is defined as the resources you use to start a business and generate value from them. Capital in Accounting are funds you use to continue your business operations and earn money in return.

The Capital can be Debt Capital, Equity Capital, and Working Capital. The ratio of these types defines your company’s Capital Structure.

Drawings

Drawings are the amount that you withdraw from your business for normal personal use. These may be in the form of Cash, Inventory, Service, or any kind which is preferred by the owner.

Drawings are the amount that is deducted from Capital invested including Retained Earnings.

Goodwill

What is Goodwill in Accounting?. Goodwill is an Intangible Asset which arises at the time of purchasing or selling any company. The extra amount which you pay or receive after the value of actual assets is called goodwill,

Goodwill may brand reputation, customer base, or patent.

Revenue

Revenue is the total income received during your normal business operations from sales of goods or services.

It is the first item on the Income Statement and an important part of business reports.

Turnover

Turnover is the number of total sales during a specific accounting period.

Turnover may be a sales turnover, and inventory turnover, account receivable turnover, and asset turnover.

Debit

The Fundamental Accounting term used is Debit for any business whether it is small, medium, or large. The Debit is the amount of any financial transaction which is written on the left side of the Account. The Expenses, Assets are written on the debit side of the account when increased.

When you face any financial event in the shape of cash payment or receipt. Then you have to decide whether it should be Debit or Credit.

Assets and Expenses when increase, we write it on the Debit Side of the account.

When Liability and Owner’s Equity decrease, you have to write it on the opposite side of the Credit which is the Debit side.

Credit

Another one of the Basic accounting terms is Credit. Credit is another one of the main and fundamental accounting terms. The financial event which you face in the shape of Sales, increasing liability and owner’s equity is written on the Credit side (right-hand side of the Account).

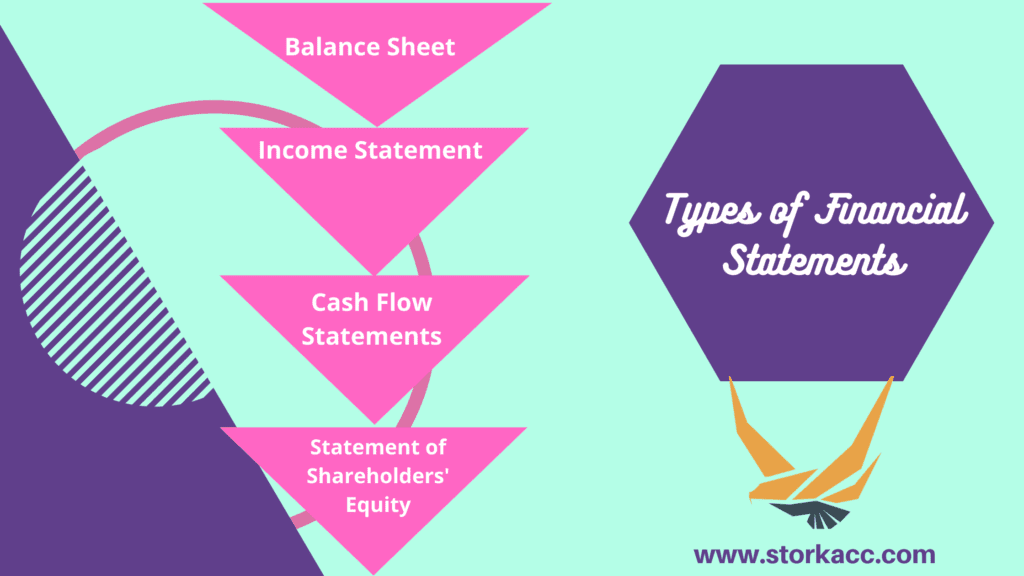

Balance Sheet

It is one of the Basic Financial statements for your small business to check financial position. In other words, called the Statement of Financial Position, show what are your assets and how much you have to pay. How much you have acquired using loans and how much you have earned.

Income Statement

The second most important financial statement of your small business is Income Statement. This statement shows your all expenses and all incomes. All types of income wrote first and all expenses are written afterward. The difference between these two shows the profitability of your business concern.

Account Receivables (AR)

Account receivable is a balance sheet item written with Current Assets. All sales which are given on credit and purchaser promises to repay in specific days are called Account Receivables.

Account Payables (AP)

Account Payables is another balance sheet item written with current liabilities.

All your purchases of inventory that are on credit and you will repay it after a time period to your vendors is called Account Payables.

Inventory

Inventory is an asset written on a balance sheet with current assets. All your purchases which you have to resell to your customers to earn profit in normal operations are called an inventory.

Conclusion

All the above basic accounting terms are described for your small business to help you control your basic Bookkeeping activity.

The financial aspect of any business is considered the backbone and has to be managed in that sense. All checks and controls are applied to get a small company in the right direction which is profitability.

If you liked this article, please share it & like our Facebook page for more updates and motivation.

Feel free to comment and get in touch with our StorkAcc Team for any help you need to make your small business successful.

11 thoughts on “28 Easy and Basic Accounting Terms for Small Business”

Good effort to educate small business owners…

Thank you very much..

please, keep visiting my site for more useful content and suggestion..

Rory Flynn

Wade Cohen

Arabella Nava

Jaxson Sierra

Tanner Winters

Rhea Bell

Ensley Boyd

Chaya Stephens

I have read some excellent stuff here Definitely value bookmarking for revisiting I wonder how much effort you put to make the sort of excellent informative website